·

Every

cloud is entirely silver It’s said that every cloud has a silver lining – that

everything bad has something good about it – but nowadays its seems more like

everything bad is entirely good and every cloud is entirely silver. Yesterday’s

economic news was all-around bad, and as a result we had a rally in stocks,

bonds and credit, as if it was the greatest news possible. The Eurozone capped

off a string of bad economic indicators recently with lower-than-forecast GDP,

showing that the continent’s economy is basically stagnating, while

professional forecasters lowered their forecast for both growth and inflation

this year. Meanwhile on the other side of the ocean, initial jobless claims

were higher than expected, contradicting some of the recent better news on the

labor market.

·

There was some

traditionally good news yesterday: Russian President Vladimir Putin

travelled to a much-hyped meeting in Crimea and called for an end to the

conflict “as soon as possible.” The cautious speech was taken as a signal that

he wants to de-escalate the crisis. (Although personally, I doubt whether

things are over quite yet: two British newspapers reported seeing Russian

armored vehicles enter Ukraine Thursday evening, while the Pentagon announced

it would send around 600 US soldiers and their equipment, including tanks, to

Poland and the Baltic states. The US presence in countries that border Russia

is not going to make Mr. Putin particularly happy.)

·

In any event, hopes for an early settlement to

the Ukraine strife plus thoughts that neither the ECB nor the Bank of England

nor the Fed is likely to start hiking any time soon encouraged the flow back

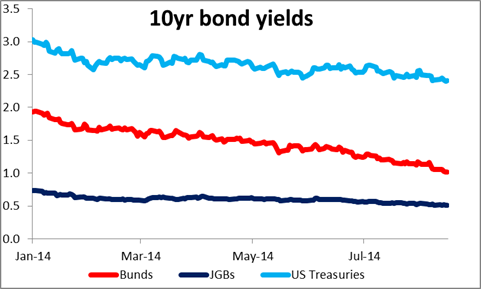

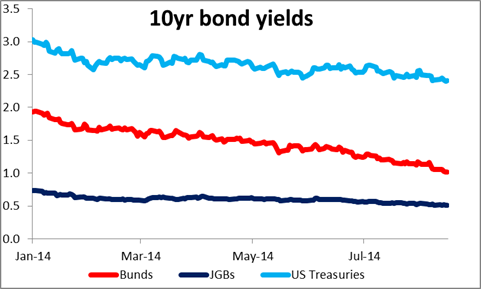

into any and all financial assets. Bond yields headed lower, with 10-year Bunds

breaking through 1.0% for the first time ever and 10-year US Treasuries

slipping below 2.40%. Bunds are now only 50 bps or so above JGBs, the bonds of

a country where the central bank is buying up more bonds than the government

can issue. The VIX index continued to decline and high yield bonds rallied as

money came back into the credit market too. But the dollar remained stable

against most of the G10 currencies and EUR/USD stayed within its recent narrow

range and once again failed to break the 1.3330 support (low for the day:

1.3349). The commodity currencies were the main gainers, which is kind of odd

when you consider that commodities didn’t do that well – copper was down, oil

fell sharply as the supply glut continued, and agricultural commodities were

generally lower too.

In any event, hopes for an early settlement to

the Ukraine strife plus thoughts that neither the ECB nor the Bank of England

nor the Fed is likely to start hiking any time soon encouraged the flow back

into any and all financial assets. Bond yields headed lower, with 10-year Bunds

breaking through 1.0% for the first time ever and 10-year US Treasuries

slipping below 2.40%. Bunds are now only 50 bps or so above JGBs, the bonds of

a country where the central bank is buying up more bonds than the government

can issue. The VIX index continued to decline and high yield bonds rallied as

money came back into the credit market too. But the dollar remained stable

against most of the G10 currencies and EUR/USD stayed within its recent narrow

range and once again failed to break the 1.3330 support (low for the day:

1.3349). The commodity currencies were the main gainers, which is kind of odd

when you consider that commodities didn’t do that well – copper was down, oil

fell sharply as the supply glut continued, and agricultural commodities were

generally lower too.

In any event, hopes for an early settlement to

the Ukraine strife plus thoughts that neither the ECB nor the Bank of England

nor the Fed is likely to start hiking any time soon encouraged the flow back

into any and all financial assets. Bond yields headed lower, with 10-year Bunds

breaking through 1.0% for the first time ever and 10-year US Treasuries

slipping below 2.40%. Bunds are now only 50 bps or so above JGBs, the bonds of

a country where the central bank is buying up more bonds than the government

can issue. The VIX index continued to decline and high yield bonds rallied as

money came back into the credit market too. But the dollar remained stable

against most of the G10 currencies and EUR/USD stayed within its recent narrow

range and once again failed to break the 1.3330 support (low for the day:

1.3349). The commodity currencies were the main gainers, which is kind of odd

when you consider that commodities didn’t do that well – copper was down, oil

fell sharply as the supply glut continued, and agricultural commodities were

generally lower too.

In any event, hopes for an early settlement to

the Ukraine strife plus thoughts that neither the ECB nor the Bank of England

nor the Fed is likely to start hiking any time soon encouraged the flow back

into any and all financial assets. Bond yields headed lower, with 10-year Bunds

breaking through 1.0% for the first time ever and 10-year US Treasuries

slipping below 2.40%. Bunds are now only 50 bps or so above JGBs, the bonds of

a country where the central bank is buying up more bonds than the government

can issue. The VIX index continued to decline and high yield bonds rallied as

money came back into the credit market too. But the dollar remained stable

against most of the G10 currencies and EUR/USD stayed within its recent narrow

range and once again failed to break the 1.3330 support (low for the day:

1.3349). The commodity currencies were the main gainers, which is kind of odd

when you consider that commodities didn’t do that well – copper was down, oil

fell sharply as the supply glut continued, and agricultural commodities were

generally lower too.

·

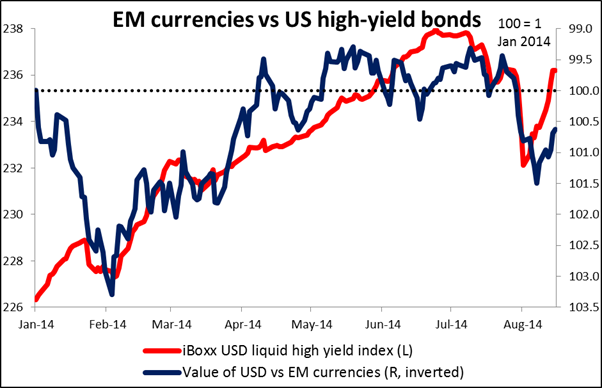

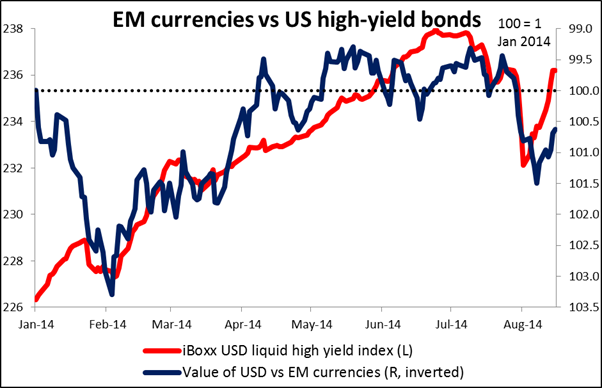

FX market implications: carry continues

to climb The general financial

euphoria had its counterpart in EM FX, where carry trades are back in fashion.

Almost all the EM currencies that we track gained against the USD (THB was the

only exception). The best performing currency was BRL, which had fallen after

an opposition candidate for President was killed Wednesday in a plane crash.

The eastern European currencies did well too, outpacing the RUB’s gains. I expect to see more and more carry

trades put on as DM bond yields fall and the higher yields available in EM

become relatively more attractive. MXN and the Eastern European

currencies (PLN and HUF in particular) seem the likely beneficiaries, in my

opinion. Investors interested in putting on carry trades might want to consider

buying these currencies against EUR, which I expect to decline further sooner

or later, or JPY, where pressure is building for further measures to weaken the

currency.

FX market implications: carry continues

to climb The general financial

euphoria had its counterpart in EM FX, where carry trades are back in fashion.

Almost all the EM currencies that we track gained against the USD (THB was the

only exception). The best performing currency was BRL, which had fallen after

an opposition candidate for President was killed Wednesday in a plane crash.

The eastern European currencies did well too, outpacing the RUB’s gains. I expect to see more and more carry

trades put on as DM bond yields fall and the higher yields available in EM

become relatively more attractive. MXN and the Eastern European

currencies (PLN and HUF in particular) seem the likely beneficiaries, in my

opinion. Investors interested in putting on carry trades might want to consider

buying these currencies against EUR, which I expect to decline further sooner

or later, or JPY, where pressure is building for further measures to weaken the

currency.

FX market implications: carry continues

to climb The general financial

euphoria had its counterpart in EM FX, where carry trades are back in fashion.

Almost all the EM currencies that we track gained against the USD (THB was the

only exception). The best performing currency was BRL, which had fallen after

an opposition candidate for President was killed Wednesday in a plane crash.

The eastern European currencies did well too, outpacing the RUB’s gains. I expect to see more and more carry

trades put on as DM bond yields fall and the higher yields available in EM

become relatively more attractive. MXN and the Eastern European

currencies (PLN and HUF in particular) seem the likely beneficiaries, in my

opinion. Investors interested in putting on carry trades might want to consider

buying these currencies against EUR, which I expect to decline further sooner

or later, or JPY, where pressure is building for further measures to weaken the

currency.

FX market implications: carry continues

to climb The general financial

euphoria had its counterpart in EM FX, where carry trades are back in fashion.

Almost all the EM currencies that we track gained against the USD (THB was the

only exception). The best performing currency was BRL, which had fallen after

an opposition candidate for President was killed Wednesday in a plane crash.

The eastern European currencies did well too, outpacing the RUB’s gains. I expect to see more and more carry

trades put on as DM bond yields fall and the higher yields available in EM

become relatively more attractive. MXN and the Eastern European

currencies (PLN and HUF in particular) seem the likely beneficiaries, in my

opinion. Investors interested in putting on carry trades might want to consider

buying these currencies against EUR, which I expect to decline further sooner

or later, or JPY, where pressure is building for further measures to weaken the

currency.

·

Today’s

events: UK GDP, US IP, Canadian unemployment

correction During the European day, the main event will be the

second estimate of UK Q2 GDP. Following the disappointing inflation report on

Wednesday and especially the halving of the wage growth forecast, a strong

reading is needed for GBP to resume its upward path. The market forecast is as

usual the same as the initial estimate, i.e. +0.8%.

·

In the US, industrial

production and PPI for July are due out. Given the soft retail sales Wednesday,

the greenback will need a solid industrial production to regain its glamour.

It’s not clear whether the forecast of +0.3% mom, a rise from +0.2% mom in

June, would be sufficient. The Empire State manufacturing survey and the

preliminary U of Michigan consumer confidence sentiment for August are also

coming out. The former is expected to decline while the latter is forecast to

improve, leaving a mixed picture.

·

From Canada, we get

manufacturing sales for June and existing home sales for July. The re-release

of July’s employment report is also due out after Statistics Canada found an

error in the original report published last Friday. (The revised report was

originally supposed to be published on Thursday, but the release date was later

changed.) We would expect CAD to strengthen if it comes in above 20.0k, the

original market forecast for the figure. However, a disappointing figure

combined with the estimated slowdown in manufacturing sales is likely to weaken

CAD.

We

have no speakers on Friday’s agenda.

No comments:

Post a Comment