Global data, FOMC support firmer dollar The

verdict from yesterday’s data was unanimous: it all supports a stronger dollar.

Data from Japan, Europe and the US agreed.

As I mentioned yesterday, Japanese industrial production plunged

in June, a stunning contrast to the surge in output in neighboring South Korea

during the month, so it can’t be put down to a sluggish world economy. Then

German inflation slowed in July, signifying a poor supply/demand balance in

Europe’s largest economy and suggesting that the Eurozone inflation too may

move lower, a negative for the euro.

The US data though was the clincher. The ADP employment report

was lower than expected at 218k vs a market forecast of 230k, but the figure

remains over 200k and in any event some payback from the previous month’s 281k

was inevitable. Then came the GDP figures. Not only was Q2 far above estimates

(+4.0% qoq SAAR vs forecast +3.0%) but also Q1 and all of the second half of

last year were revised up as well, meaning that 2013 yoy real GDP growth was

revised up to 3.1% from 2.6%. On top of which, the Q2 core PCE deflator grew

2.0% annualized, meaning the FOMC has hit one of its two targets.

The

better economy and higher inflation were reflected in the FOMC statement. There

were no significant changes in their policy guidance, but the tone of the

statement was nonetheless slightly more hawkish, in line with the improvements

in the economy. They noted that inflation is moving towards their target and

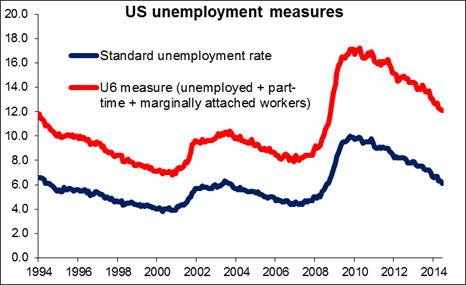

that labor conditions had “improved.” But on the other hand, they emphasized

that other indicators besides the unemployment rate show continuing

difficulties in the jobs market. The market focused on that point and

interpreted the statement as dovish, which I think is a misinterpretation. It

looks to me as if the Committee is trying to play down the improvement in the

unemployment rate and instead focus on other indicators that still show a

difficult labor market to enable them to keep their flexibility about the

timing of a rate hike. For example, there may be more emphasis from now on the

broadest measure of unemployment, the U6 measure, which includes people

“marginally attached to the labor force” as well as those with part-time jobs

who want to work full-time but can’t find full-time jobs. This version remains

quite elevated.

The

better economy and higher inflation were reflected in the FOMC statement. There

were no significant changes in their policy guidance, but the tone of the

statement was nonetheless slightly more hawkish, in line with the improvements

in the economy. They noted that inflation is moving towards their target and

that labor conditions had “improved.” But on the other hand, they emphasized

that other indicators besides the unemployment rate show continuing

difficulties in the jobs market. The market focused on that point and

interpreted the statement as dovish, which I think is a misinterpretation. It

looks to me as if the Committee is trying to play down the improvement in the

unemployment rate and instead focus on other indicators that still show a

difficult labor market to enable them to keep their flexibility about the

timing of a rate hike. For example, there may be more emphasis from now on the

broadest measure of unemployment, the U6 measure, which includes people

“marginally attached to the labor force” as well as those with part-time jobs

who want to work full-time but can’t find full-time jobs. This version remains

quite elevated.

Philadelphia Fed President Plosser dissented, as he thought the

statement did not “reflect the considerable economic progress that has been

made toward the Committee’s goals.” There are likely to be more hawkish

dissents as time goes by.

Looking at the improvement in the US economy and the changes in

the statement, it appears to me that the FOMC is on course to finish tapering

off its bond purchases as scheduled in October. Moreover, if the next several

labor and inflation reports continue to move in the same direction that they

have been moving, we could soon see more concrete indications of when the Fed

will begin raising rates. So far the FOMC’s own forecast is that rate hikes are

likely to begin in February next year, vs the market’s forecast of August. I

think the market will have to move closer to the FOMC’s way of thinking and

that this change in market view will continue to provide support for the dollar

going forward.

The data and the FOMC report bolstered the dollar against almost

every currency we track, both the G10 and EM currencies. EUR/USD is opening in

Europe below 1.34 for the first time since last November, while GBP/USD is

opening lower for the 10th day out of the last 15. Turnover increased notably

and there was apparently heavy demand for currency options in the US as

investors think we could be entering into a period of greater volatility.

Although as I noted recently the daily ranges are some of the narrowest on

record, on the other hand looking at the rates from the beginning of the month

to the end, it appears that currencies are starting to trend. The range for

EUR/USD in July as a whole has been 2.5%, which is more than half the year’s

range of 4.7%. The July range is not as much of the year’s range for USD/JPY or

GBP/USD, however. EUR/USD may finally be starting to show the effects of the

divergence in monetary policy between the ECB and the Fed.

Today: During the European day, the UK Nationwide house price

index is forecast to have slowed to +0.5% mom in July from +1.0% mom the

previous month. GBP has been weak recently and a figure like that could be an

excuse for further selling. Germany’s retail sales are also coming out and the

forecast is for a rebound in June’s figure. We also have the German

unemployment rate for July and Eurozone’s unemployment rate for June. Both

rates are expected to have remained unchanged, at 6.7% and 11.6% respectively.

The bloc’s CPI estimate for July is also coming out and is expected to remain

at June’s 0.5% yoy. Yesterday’s German CPI had only limited impact on the euro

so this is likely to too if it is within estimates.

From Canada, the GDP for May is expected to have increased by

0.4% mom, an acceleration from +0.1% in April, driving the yoy rate up to 2.3%

from 2.1%. That could cause some profit-taking in USD/CAD.

In the US, the Chicago purchasing managers’ index for July is forecast

to have slightly increased. The initial jobless claims for the week ended 26th

of July are also coming out and the forecast is for the figure to increase

marginally. These figures are not dramatically better but as long as they are

not worse, they should not derail the dollar from its upward trajectory, in my

view.

No comments:

Post a Comment